Are Home Prices Dropping?

- Written by Paul The Freedom Journalist

- In Economic Warning, Prepper Frenzy

Home market has always been an intriguing factor to our economy. It is something that people always talk about when discussing the well-being of an economy. Unlike stock markets where they are mostly paid attention to by traders, investors, and analysts, home markets touch the livelihood of every individual: whether you are a college student looking to rent an off-campus apartment with a roommate, a young professional renting near the downtown of a big city, a young coupling looking to buy their first home, a retiree looking to downsize, or even just an investor seeking opportunities to become a landlord. And of course, let’s not forget about the hundreds of thousands homeless people across the country. We all need to have a place to shelter and rest. To most people, the cost of housing will take up a large portion of their paycheck. This could be the rent payment for renters or the mortgage payment for homeowners. Even if you are an individual blessed enough to be able to buy a home with cash, that still carves out a large chunk of your saving that could otherwise be used as retirement. Nevertheless, it is safe that we don’t have any choice because housing is simply one of the top three living necessities (along with food and water) and it is so darn expensive.

The recent COVID-19 outbreak has made this intriguing market even more intriguing. As the nation implements severe economic lockdown and social distancing measures, many businesses and individuals that had already stretched thin prior to the pandemic are now taking another hit of being shut down and losing revenues due to virus fear. If you are interested in reading more about how COVID-19 triggers the current economic crisis, please check out our article, Is Covid-19 The Cause or Trigger To The Current Economic Crisis? And now as we enter the 10th week of the outbreak, many of them that had been on the survival mode are now on verge of bankruptcies. Consequently, millions and millions of Americans were getting laid off every week. This is making everyone who had been affected very nervous. “How am I going to make my next mortgage payment?”. “How am I going to pay the rent?”. Some people argue that a housing crash is going to be unavoidable. While the situation got more daring, our “beloved” Congress had since passed the CARES Act to provide people with stimulus checks and housing relief. Under the CARES Act provisions, if you are a homeowner and your mortgage is backed by federal government, you may be able to request mortgage forbearance (suspend payments) for up to 12 months. In addition, foreclosures and evictions will be suspended for at least 60 days. Similarly for renters, CARES Act provides an eviction relief of 120 days during which the landlord may not charge you late fees, penalties, or other charges for paying your rent late. While these provisions do grant people temporary relief, it doesn’t remove the obligations. One would still need to pay back everything they owe either right after forbearance period or need to work out a new repayment plan with the bank or landlord. In addition, these newly introduced legislations also make lenders and mortgage servicers very nervous because they also got a balance sheet to maintain and could be negatively impacted as a result; they also want relief from the government. We see this chain of reactions starting to trickle down. So how will all these impact the direction of the housing markets? Will housing market crash 2020? Is it a good time to buy a house? We will discuss them here, but please keep in mind that I am not a financial advisor so I don’t give financial advices. At the end of the day, you are responsible for your own financial decisions. Everyone’s situation is unique, and real estate markets are very local. In other words, what happens in downtown Manhattan is likely going to be very different from a rural town in Iowa. Some markets are going to do better than others. The discussion here is not about coming up with a prediction for a specific market, but rather to explain the big picture why housing market is in its current state and what important factors will be shaping its future. Mostly important, this site does not just talk about people’s opinions. We are all entitled to our opinions, but they could be far from the truth. This is why we also talk about the Bible, which is the Word of God and the absolute Truth. So here we will be looking for any biblical reference that may provide any indication as to where the housing market is going.

What Do Market Data and Key Players’ Actions Tell Us?

Before going into specifics to discuss how the home market will perform, it is important to get the latest market data and to see what the key players (realtors, home builders, Federal Reserve, and mortgage lenders) are up to amidst COVID-19 because will give good insights into the future of the market.

In an article from Associated Press, it describes how the home prices were rising at a steady pace in February then all the sudden viral outbreak hit and home sales plummet like running into a wall. This is largely in part due the shelter in place order throughout the country. It says in the article that “Home price gains will likely slow in the coming months with sellers forced to cut asking prices. However, fewer properties are being listed for sale with activity all but shut down, which could provide some pricing support”. In other words, all buying and selling activities decline, so it is hard gauge at this point how that would impact the prices.

This also appears to be the case for new home construction as well. According to an article from KOMONEWS, US home construction collapsed 22.3% in March compared to February. Spring is typically the busiest season for real estate activities and yet a big drop in new construction had been recorded in the first month of spring. However, ceasing in construction alone does not suggest which way the home prices will go as it could be a result of fewer buyer activities or simply because home builders decided to halt things for safety precaution. It is too early to tell at this point.

One recent development that isn’t too early to tell is the falling mortgage rates as a result of Federal Reserve’s recent cut to calm the markets. In a recent news article by MarketWatch titled “Mortgage rates fall sharply as the Federal Reserve brings stability to the mortgage market”, it says,

“Mortgage rates roughly follow the yield on the 10-year Treasury TMUBMUSD10Y, 0.615%, which dropped below 1% again this week after shooting much higher when the Federal Reserve announced it was cutting its benchmark interest rate and engage quantitative easing to help economy weather the coronavirus pandemic”. It goes on to say,

“The Federal Reserve brought clarity to the mortgage market this week, which helped to stabilize rates. The Fed announced that it will engage in unlimited bond-buying in response to the coronavirus outbreak, which included purchases of mortgage-backed securities……The Fed stepping in this week had a ‘huge psychological benefits’ for lenders, which allowed them to feel comfortable bringing rates lower”.

But that’s not the verdict. There is a whole lot more to the story. In a separate news article by Reuters titled “JPMorgan Chase to raise mortgage borrowing standards as economic outlook darkens”, it shows even though the Fed brings the rate lower, the lenders aren’t feeling as comfortable giving out mortgages as before so they decided to raise the mortgage borrowing standard. It specifically says in the article, “customers applying for a new mortgage will need a credit score of at least 700, and will be required to make a down payment equal to 20% of the home value”. So while the mortgage rate is low, not too many people can actually take advantage of it because banks have tightened the standards. In fact, most mortgage applications during this period have been refinancing applicants. They are the ones who want to get a mini bail-out from the Fed.

Two Competing Forces: Free Market Force vs. Central Bank Intervention

So one can see that there are two competing forces at play that will ultimately decide the direction of the home markets. One of them is the free market force based on supply and demand and the other is the central bank intervention. The two forces have opposite effect to the market so it is like an arm wrestle between the two; whichever one prevails will likely dictate how the home markets move. Here we will be discussing them separately:

1. Free Market Force Based on Supply And Demand

One of the most fundamental concepts in economics is scarcity. Scarcity is the lack of resources to produce all goods and services people want. Because people have unlimited wants yet the resources (whether natural, human, or capital) are limited, the principle of supply and demand emerges. Supply is the amount of goods and services people are willing to provide for a return. Demand is the amount of goods and services people are willing to pay to receive. In a free market world, the balance of between these two decides the price point for all goods and services. That same goes for home markets as well. If there are lots of buyers (demand) and not too many sellers (supply), then home prices will increase to a point until demand and supply become equal again. On the other hand, if there are lots of sellers and very few buyers, then home prices will drop until balance is reached again. These are textbook principles in a perfectly run free market world where the price fluctuates for supply and demand to find its equilibrium.

In a perfectly run free market world, supply and demand dictate the price of everything. There is no government intervention. That should also include the relationship between borrowers and lenders, and thus interest rate. Supply and demand should also dictate the interest rate. If more people are saving money than those borrowing money, the interest rate should go down until two sides become equal. If more people are borrowing than those that are saving, the interest rate should go up until equilibrium is achieved once again. If you think about it, this is actually very healthy as it keeps the system very balanced. Whenever there is any disruption to the system, it immediately goes into the direction of healing even though the process of returning to equilibrium can be somewhat painful.

Also, in a perfectly run free market world, government intervention should be kept at a minimal. As a result, there should be very little tax, but at the same time there will be ZERO help from the government for any forms of disaster relief, stimulus packages, unemployment checks, student loan forgiveness, or bailouts to businesses and individuals that could have been affected by natural disasters, manmade disaster, and economic downturns etc. After all, doing business is a risk and reward choice. You bear your own risk and you get to keep your reward. If you are making money in a sunny day, good for you and you get to keep them. But if you are losing money on another rainy day due to something unforeseen, good luck, you are on your own. It is very consistent with another fundamental economic principle: the higher the risk, the higher the return. Some may think this is reasonable, some may think this is unreasonable, but this is what a perfectly run free market capitalist world will be like.

So if COVID-19 Pandemic hits a perfectly run free market economy resulting in massive layoff and unemployment, the home prices are most certainly going to drop because there will be many sellers and very few buyers. Some will lose their homes because of foreclosures. People will be hoarding cash, consequently interest rate will shoot through the roof. In addition to higher interest rate, banks will most likely continue to tighten the lending standard. If you are skeptical, just imagine that banks are hoarding cash like everyone else and they won’t even let people get a mortgage. If you need to buy a house, you need to pay cash. When that happens, how much do you think the homes will be worth? While the government and mainstream media may call this a “chaos”, “storm”, “downturn”, or whatever, so that they can step in to “calm” and “control” the situation, there is really nothing to be calmed here. This is perfectly healthy and normal. It is nothing but the free market force is at work searching for the new price point so that the supply and demand can be at equilibrium again. Again this process automatically get you to a very balanced market.

2. Central Bank Intervention

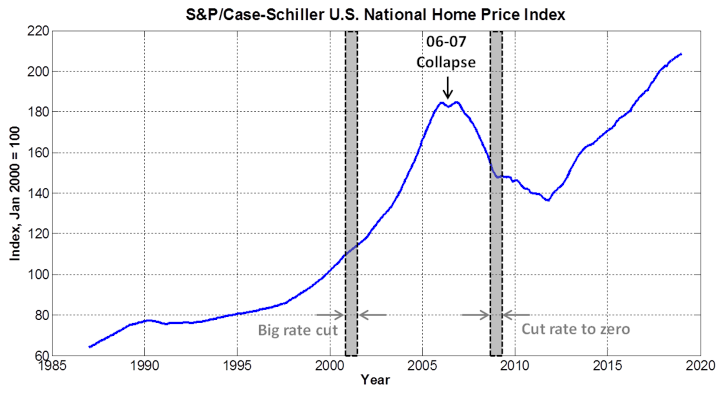

Let’s take our home market as an example. Instead of letting the free market to find its own interest rate to balance out lending supply and demand, our central bank decided to artificially suppress the interest rate. And they don’t just do this for a short period of time. We’ve had low interest rate for the last two decades. In essence, low interest rate encourages people to borrow and spend money while at the same time punishing the savers because if you’d just put your money in a savings account, you are losing money by the day because the interest you earn cannot catch up to the inflation. So people put their money into the stocks and real estates, driving up the prices across the board. Have you ever wondered why our homes are so not affordable? You should thank our government and central bank for not allowing the free market to find a fair price point. Let’s look at the following Case-Schiller Home Index:

The two vertical grey bars show the two major rate cuts Federal Reserve implemented to “combat” the dot com crash and 08 financial collapse. In both times, they claimed the economy was in trouble and needed to be “stimulated”. Come on people, we had dot com bubble in the late 1990s because of excess speculation in internet-related companies. At the height of the dot com bubble, you could really have these companies raising substantial amount of money via an IPO before they even make a single cent of profit. The whole thing was nothing but “speculation”, therefore, it came tumbling down fast in a crash. The crash is the free market force doing work to bring things back to balance and reality. It is healthy. Similarly for 08 housing collapse, it was the free market force trying to pop the housing bubble and bring things back to normal because the housing bubble was fueled by bad mortgages. At the time almost any adult with a pulse could get a mortgage. They didn’t even care if you can pay it back. However in both times, rather than letting the free market to play out its course of balancing, our central bank decided to step in with stimulus low interest rate policy. So what did these do to our home prices? they shot through the roof due to all the cheap lending and money printing (aka quantitative easing). But that doesn’t mean central bank intervention prevails because free market force will come back stronger every time. The longer you had been detached from free market, the bigger its force accumulates to come back to rock you harder later. The problem we had with the dot come bubble, we never let the free market cure it. So it grew bigger and went into real estates and we had a housing bubble that is a lot more severe and widespread. Again after the housing bubble pops in 2008, instead of letting free market find the balance, they decided to inject a higher dose of steroid by lowering the interest to ZERO and PRINT MONEY to “save” us from crashing further. And guess what, it worked. The crash did slow, reversed its course, shot higher to moon again. Except this time, we don’t just have stock and housing bubbles, we also have a giant debt bubble waiting to rock the whole earth. If you want to understand the debt bubble, please check out our article, Is Covid-19 The Cause or Trigger To The Current Economic Crisis?

What Do I See How Home Prices Will Go?

Another way to ask this question is which one do I think will prevail? Free market force or central bank intervention? It is a tough one. On one hand, you have a giant debt bubble looming after decades of lending imbalance. On the other hand, you have a central bank who can create “unlimited” money supply. So it is really a tough one to predict how home prices will go. If I have to guess, I will say that the home prices will definitely drop a lot when the debt bubble pops because the effect will be too overwhelmed for the central bank to react in the beginning. But then when central bank eventually figures out how to bail out everyone include everybody’s mortgages, student loan etc. using money created out of thin air, home prices are likely to increase back up or even higher. If that’s the case, we are looking a serious possibility of hyperinflation, where everyone can be a millionaire, but a million dollar can’t even buy you a loaf of bread.

Are There Any Biblical Reference On The Future of Home Markets?

As you know, this website doesn’t just talk about opinions, we also talk about the Gospel and the Word of God in the Bible because it is the absolute Truth and the only thing that 100% counts. So our discussion about home prices can never be completed without mentioning what Bible has to say. While there isn’t a specific reference regarding home markets and values in the Bible, there are descriptions about the economic situation during the endtime which can give us a clue or two. One of them is in Revelation 6:5-6:

“When the Lamb opened the third seal, I heard the third living creature say, ‘Come!’ I looked, and there before me was a black horse! Its rider was holding a pair of scales in his hands. Then I heard what sounded like a voice among the four living creatures, saying, ‘A quart of wheat for a day’s wages, and three quarts of barley for a day’s wages, and do not damage the oil and the wine!’ ” – Revelation 6:5-6

The part that is underlined provides us a pretty good picture of the economy prior to the Second Coming of Jesus Christ. “a quart of wheat” and “a quart of barley” are food. They are our everyday necessities. “A quart of wheat for a day’s wages” means most people have to spend all of their wages on everyday necessities. In other words, people are living paycheck to paycheck and they barely make ends meet. This is most likely the depict of an inflationary economy where wages stay relatively stagnant compared to all the rising costs around us. In addition, “oil” and “wine” are not everyday necessities, they are luxury. The represent the riches. “do not damage the oil and the wine” would mean that rich people wouldn’t be affected at all. This 2000-year old Bible prophecy could be foretelling us that during the endtime, the wealth gap will increase. The rich will stay rich, the poor will get poorer. Isn’t this what we have now? Well it could get a lot worse.