This is year 2019 and it has been over 10 years since the 2008 US Financial Crisis and people have been wondering whether we will see another economic downturn in the near future. And if one is certain to take place, how severe will it be, what industries are likely to be impacted, and what can we do to be prepared.

People speculate and seem eager to find out the answers of “if”, “when” and “how”, but the truth is no one knows these for sure except God. In fact, many “experts” who make a living speculate on these topics on the financial channels right before the 08 Financial Crisis were claiming that everything was going great. Just because you are a talking pundit and know how to speculate does not mean you know any better about what the future holds.

However, that also does not mean we should be delusional and assume everything is so great.. After all, God gives everyone a functional brain to think and a Bible to read. Just as the Bible says,

Having said all that, I am not here to forecast or make a prediction as to when the collapse will take place but there are many troubling signs that show we could be near a big one. And here are some of the major ones:

I got to admit I am a fan of mixed martial arts (MMA) not because I love watching people getting beat up but because of its competitive nature when you see those world-class fighting athletes, each possessing a set of unique skills, fighting for superiority within the same rules and weight classes. Now imagine that we have a fight between a lightweight fighter and a heavyweight fighter or if the referee does not hold both fighters to the same standard, then I am sure it isn’t nearly as competitive and the outcome of the fight becomes very boring and predictable due to its unfairness.

The above analogy of unfairness is exactly what the Federal Reserve’s monetary policy did to the economy over the last two decades. And this isn’t just the US, central banks all over the world are doing the same thing, which is why this upcoming collapse is going to be global. Instead of letting free market of supply and demand drive and correct its own course, they chose to come in with monetary policy to tip the scale heavily in favor of one side over the other and did it for such long period of time.

From the biblical perspective, It is of no question that God favors just and balanced scale as it said in Leviticus

“You should do no wrong in judgment, in measures of length or weight or quantity. You should have just balances, just weights, a just ephah, and a just hin: I am the Lord your God, who brought you out of the land of Egypt.” Leviticus 19:35-36

Obviously God does not favor unjust competition right, but then why do all the central banks around the world do this? What are their reasons behind? Aren’t they all run by top-notch economists who should know what they are doing?

I mean it doesn’t take a rocket scientist to figure out that when you forcefully pull something far away from its equilibrium and do it for an extended period of time, you are creating a very dangerous and explosive situation.

Of course these are very smart people who should know what they are doing. But the real question is who do they work for? Do they work to create a healthy economy for the mom and pop like you and me or do they work for somebody else?

While many media and textbooks frequently teach that the primary purpose of Federal Reserve’s role is to serve the public, it is important to understand that even though its Board of Governors were presidentially appointed and that it exists because of an act of Congress, it really isn’t part of the government. According to Wikipedia, The Federal Reserve System proudly considers itself “an independent central bank because its monetary decisions do not have to be approved by the President or anyone else in the executive or legislative branches of government, it does not receive funding appropriated by Congress, and the terms of the members of the board of governors span multiple presidential and congressional terms.”

Great, free of government intervention is a good thing, however, Federal Reserve Banks are really set up like private corporations. Commercial banks are required to hold stocks and can earn dividends while electing six of the nine members of the Federal Reserve Bank of their region. Yes, holding these stocks does not carry with it the same control and financial interest given to holders of common stocks as in typical for-profit organizations, but it is safe to say that central banks are really owned and run by bankers.

If the central banks are run by the bankers, do you think they have your best interests? Or do you think they have the best interests of their friends at Wall Street?

Let’s take a look at the specifics of the monetary policy:

One of the powerful weapons that our central bank Federal Reserve has is its ability to set the interest rate of the market. Most people know this as a fact but they may not realize that this is such an enormous power granted not to a government agency but to a private institution owned and run by bankers (as we discussed in the previous section). Interest rate by its definition is the rate the lenders charge the borrower for taking out a loan over a period of time. This number basically dictates the supply and demand between borrowers and lenders. If the interest rate is too high, there will be much fewer borrowers and a lot more lenders. On the other hand, if the interest rate is too low, there will be many borrowers and very few lenders.

Now the illustration does not mean that everyone goes out there and try to be borrowers or lenders based on the interest rate because nobody would be following it. Instead the interest rate the Fed decides set the guidelines for the banks, who basically are our primary borrowers and lenders nowadays. The way it works is that Federal Reserve sets two kinds of interest rates called Federal Fund Rate and Discount Rate.

In short, Federal Fund Rate is the interest rate when banks loan to one another while the Discount Rate is the rate when a bank bothers from the Federal Reserve directly. Discount rate is usually higher than Federal Fund Rate because Fed wants to encourage banks to borrow from one another first. So how does these two rates set the guideline for the banks and how do they affect us?

Well first we all know the balance of our bank accounts are the money we loan to the bank. In this case the bank will never pay us a yield higher than Federal Fund Rate or Discount Rate. I mean why would they? Why would they pay us a higher yield when they can get the money from another bank or from Fed directly at a much lower interest rate. Therefore these two rates controlled by the Fed essentially set the upper bounds of our bank deposit yield. In fact, typical bank accounts are expected to have yield much lower than these upper bounds.

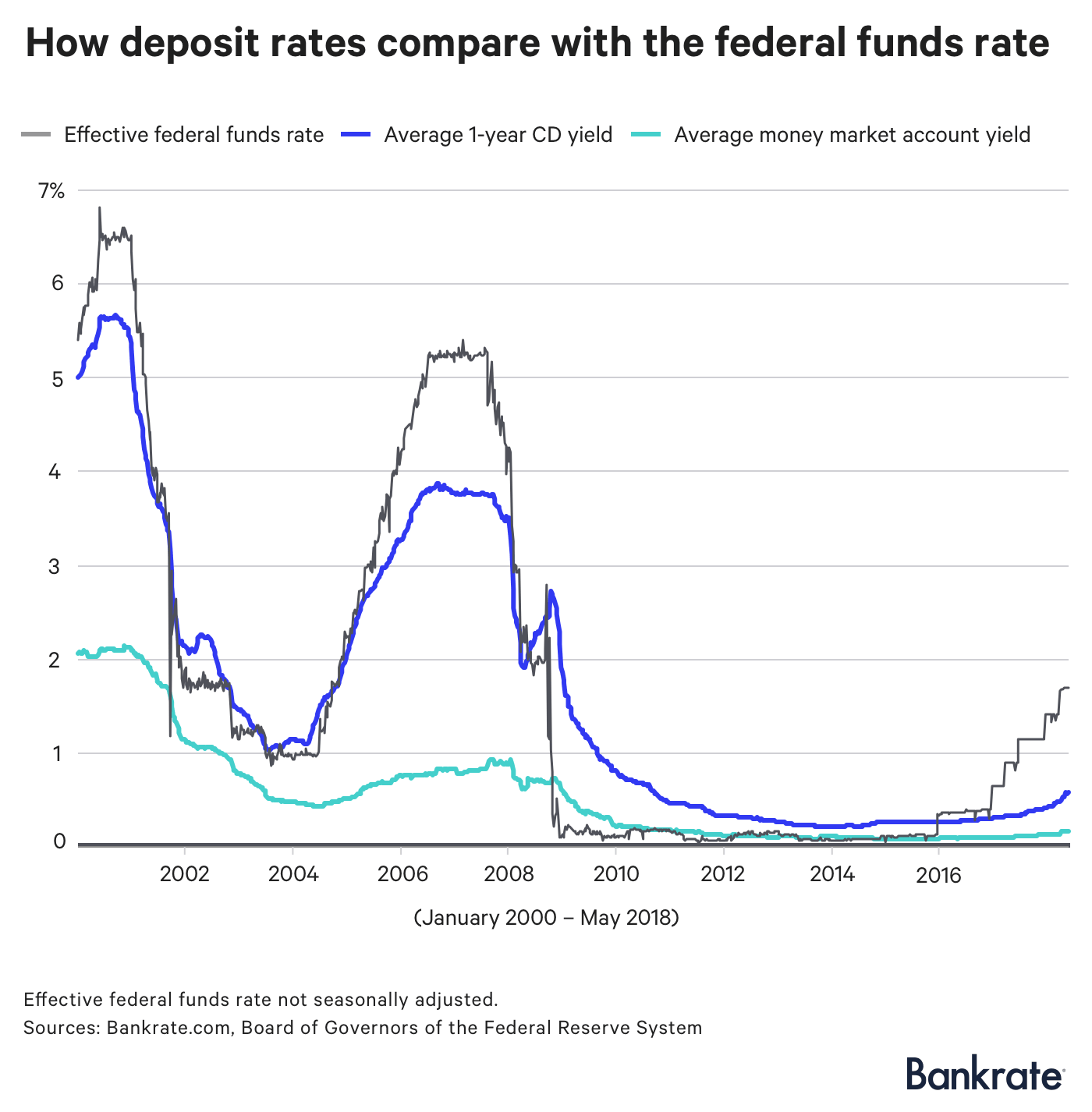

It is evident from the above figure that Federal Reserve decided to drastically lower the Federal Fund Rate during the 2001-2002 period and the 2007-2008 periods. They justified the rate drop as a necessary mean to battle the repercussion of Dotcom Collapse and 08 Financial Collapse. From the figure, one can clearly the 1-year CD yield stays with and follows the Federal Fund Rate fairly well whereas the money market account (good representation of the saving account of an average American) reacts much slower to the rate changes and two drastic rate drops during 2001-2002 and 2007-2008 had essentially forced the saving account interest rate to a historical low (basically zero) and remained there for the last decade.

Why is this so significant?

Why is this long-term interest rate suppression by the Federal Reserve so significant? Because this is like taking away people’s savings and give them to the banks period, or in other words robbery. How so?

When the deposit interest rates are so low, you are essentially loaning your money to the banks at zero percent interest but when you need to take out a loan (for example, business loan or student loan), the banks obviously do not loan you out at zero interest rate (nice try), they loan you out at best on what they called prime rates, rates commercial banks charge their most creditworthy customers, which are usually 3 or 4 basis above Federal Fund Rate and Discount Rate. So it is really not hard to see who is making a fortune here. Yes, but that’s not enough against Fed’s low-interest policy as banks always make a killing regardless how Fed sets the rates since prime rates are always going to be that much higher.

That is true but what is more disgusting about this zero interest policy is that it essentially punishes savers and encourages people to borrow and spend the money, which is fundamentally against the biblical teaching that encourages us to preserve, save, and do not spend beyond what you can afford. It says in Proverbs

Yet we have our central bank, who controls our monetary policy, basically encourages people not to save but to borrow and spend instead. After the Dotcom and 08 Financial Collapse, our central bank somehow feared the most about having a deflation as in the 1930 Great Depression where people became too traumatized to spend. So they rolled out these big rate drops as an encouraging sign to “restore” consumer confidence. But as dumb and ridiculous as these monetary policy may be, no you don’t need to rush to restore consumer confidence when you just come off a collapse as a result of people’s reckless and overhyped spending behaviors. This is like when your friend just went broke and you helped him apply for another credit card. Yes, that new credit card may give you a temporary relief but it will only make the situation much worse down the line. Instead of letting the market heal and correct its own course following these collapses, our central bank chose to step in with economic “steroid” to make everything seem like okay while kicking the can down the road. Just imagine when an pitcher injuries his throwing arm, rather than taking time off to heal, he decides to inject steroids and returns to action the next day. How far do you think he can go before his arm implodes on him? How much farther do you think our economy can last before it implodes on us with these types of unbalanced economic “steroids”?

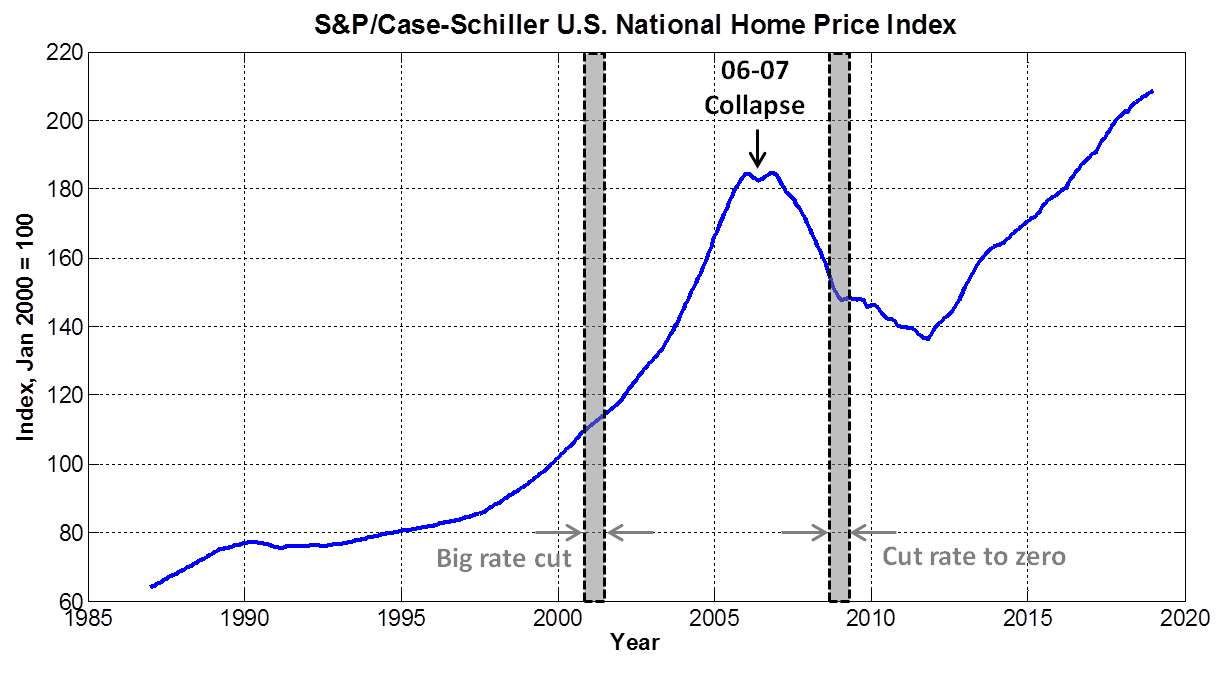

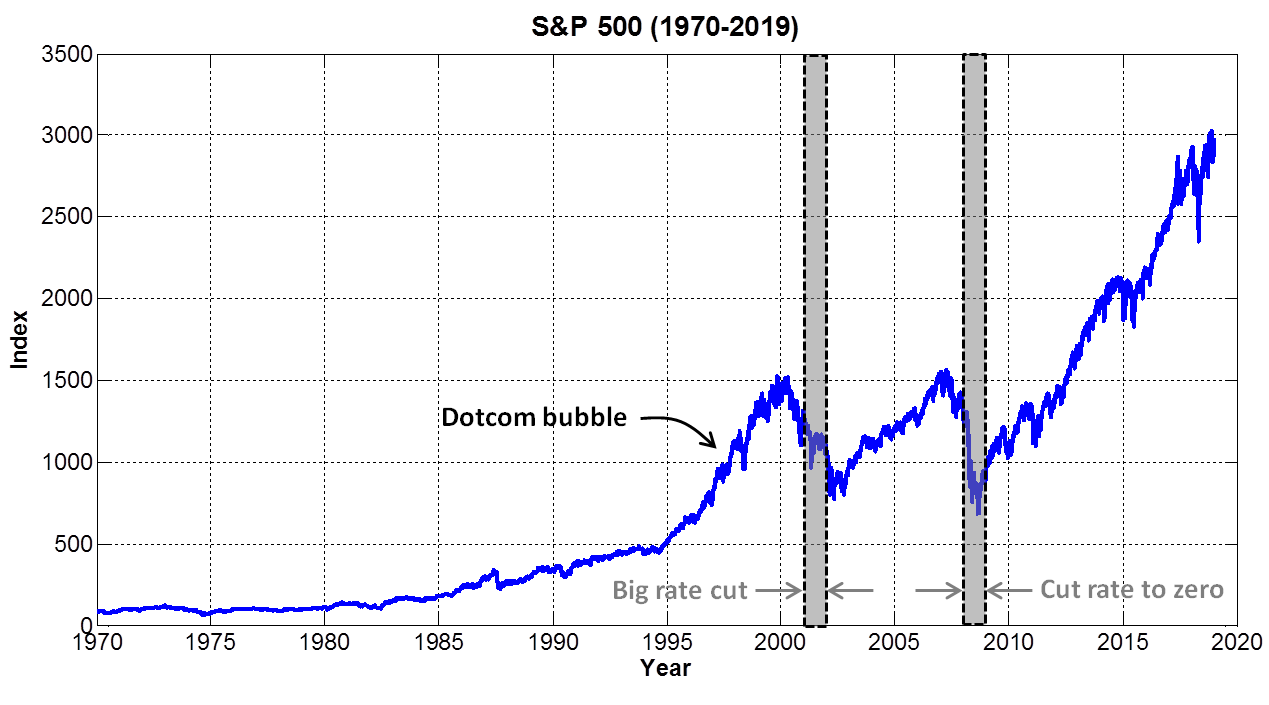

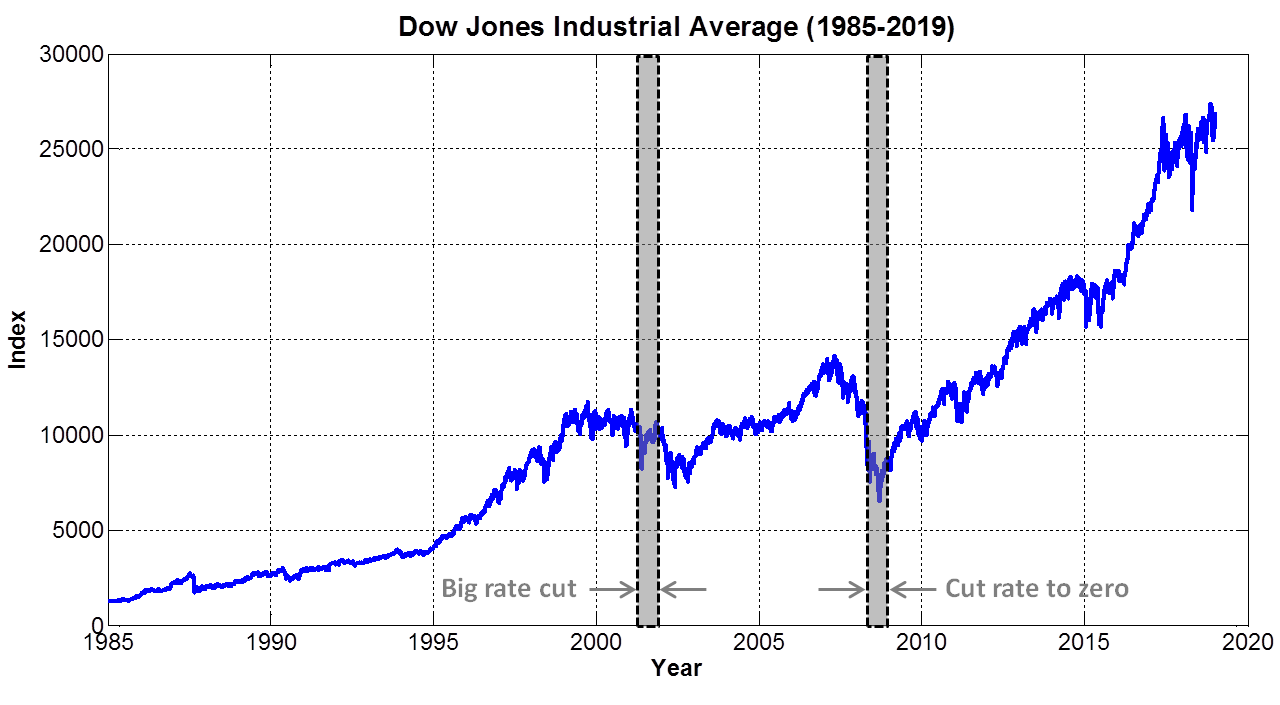

So what are the consequences of the low interest rate? Well since there are no incentives of leaving money in the bank accounts, many investors driven by greed start pouring their money elsewhere driving up assets such as real estates and stocks into bubble territory. This is further fueled by many people wanting to take advantage of lower interest for a mortgage or student loan. Please take a look at the following well-known indexes for real estate and stock prices (Case-Schiller National Home Price Index, S&P 500, and Dow Jones Industrial Average) and tell me that they are merely a coincidence. In each of these index figures, the grey stripes represent the periods in which Fed had made significant cuts to the interest rate. And not long after these cuts, we see rapid appreciation of home and stock prices. This is even more pronounced during 2008-2009 when Fed essentially drops the interest rate to zero not to mention all the economic stimulus and QEs (Quantitative Easing) they added on top of that.

Again it is just so ridiculous how every time we came off a collapse as a result of people’s reckless spending behaviors, instead of going to through pain and letting the markets correct and heal on its own, central bank always tries to create this image of wealth and pretend that everything is okay. As a result of these monetary policies, home and stocks prices soar. Yeah! People are more wealthy because their home and stocks are worth more now. Do we need to be so delusional? It is the same house except a few years older. Don’t you feel something is fishy when the stock of a company is almost 3 times higher yet the company earning stays the same or even lower?

You are not creating any more wealth by creating bubbles ladies and gentlemen. Yes your home is worth more now but it also costs more to buy another home. All we are getting is just inflation across the board. Well except during these bubbles, many jobs such as real estate agents, financial analysts, mortgage personnel, stock analysts, and fund managers are flourishing. While I have nothing against those professions and have no problem that they make money to feed their families, the reality is these professions tend to suffer the most during a collapse or economic downturn because bubbles aren’t real wealth. Real wealth isn’t about playing games with money. Real wealth is the wealth generated from producing and manufacturing goods/services that improves people’s quality of life and this type of wealth is fairly recession-proof.

For those of you who still think that you are not affected by these monetary policy, you must have been living in a cave. While the number in your saving account where you are earning zero interest on may not change (if you are lucky), costs of everything around you skyrocket. Home, price, insurance premiums, rent, healthcare you name it. The money you have in your saving account is losing its purchasing power by the day. I hope by now you still think central bank has your best interest.

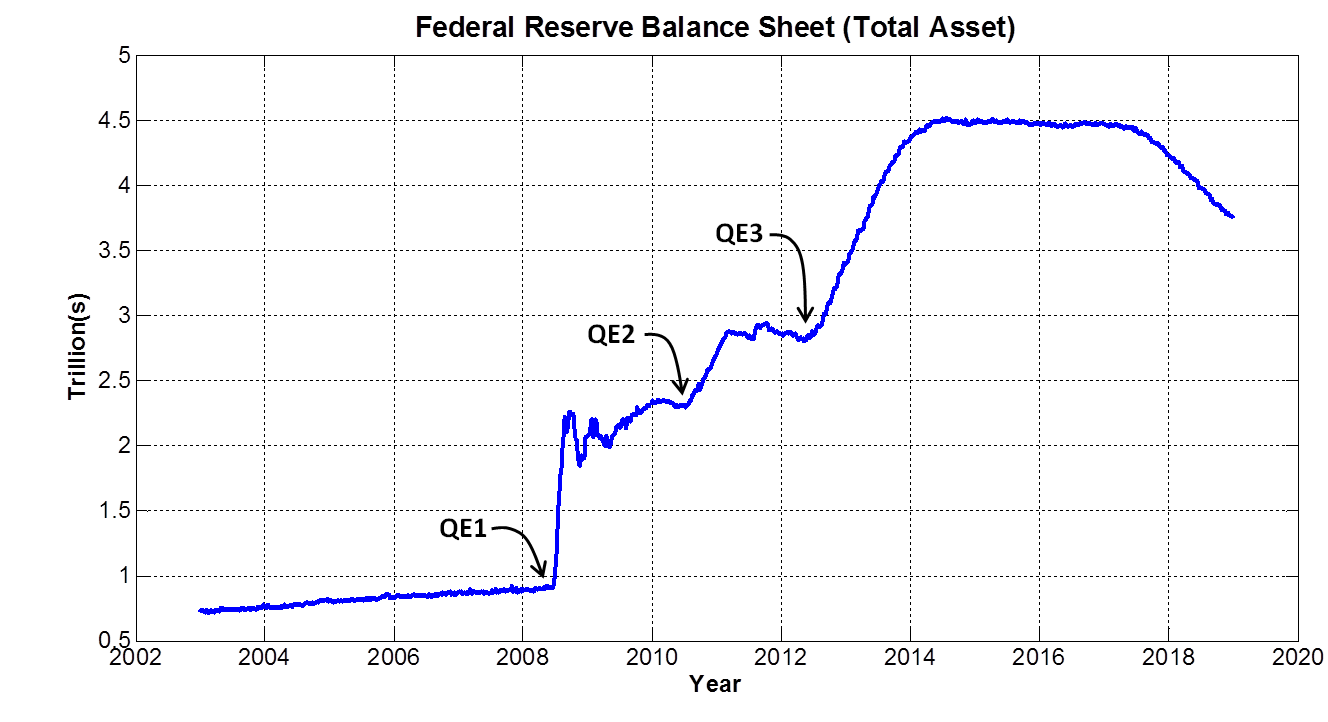

Just when the Fed couldn’t lower the interest rate any further following the 08 financial collapse, they also decided to “stimulate” the system by pouring in trillions of money into the banking system. As much as the term “Quantitative Easing” may sound so scholastic and educated, it is nothing more than central banks purchasing mortgage-backed securities and treasury notes from its member banks in order to increase the money supply and encourage lending, investment, and spending. They were using such as educated term “Quantitative Easing” to convince you that they are the experts and they know what they are doing, and they have everyone’s best interest at hand.

Now one may wonder where do central banks get the funds to purchase these assets? Excellent question! They simply have the ability to create it out of thin air. The central banks are being granted with this unique power such that when they need money, they can simply create it. This is what financial media speaks of when they refer to the central bank “printing money”. In reality, they don’t actually run to the printing press to print. This can be as simple as typing out a number with a keyboard and there you have it. It is funny how most of us have to work so hard to add a few hundred bucks into our account balance and yet central banks can just add trillions to their balance within a few keyboard strokes.

Speaking of account balance, the following chart shows Fed’s balance sheet since 2003. One can clearly see that Fed has begun the astronomical expansion of its balance sheet with these QEs. Fed’s balance sheet is straightforward to understand. Basically anything which Fed pays money for becomes Fed’s asset and shows up on its balance sheet. When Fed buys government securities or extends loans to its member banks, it simply pays by crediting the reserve accounts of the member banks. If the member banks wish to convert the money lying in their reserve accounts into hard cash, Fed provides them dollar bills so their reserve account credit balances would decrease and the currency in circulation would increase. Because of the bank reserve requirement, banks are required to hold 10% of their deposits either in cash at banks’ vault or at the local Federal Reserve bank at the end of each day. With these QEs, Fed gives banks much more than they need in reserves. While the banks are seeking to make a profit by lending the excess to other banks, Fed also lowers the Federal Fund Rate, the interest rate banks charge for loaning to one another. So this increase in money supply coupled with low rate basically gives the banks that much liquidity to make more loans and increase lending to business to expand and individuals to buy things like homes, cars, and boats.

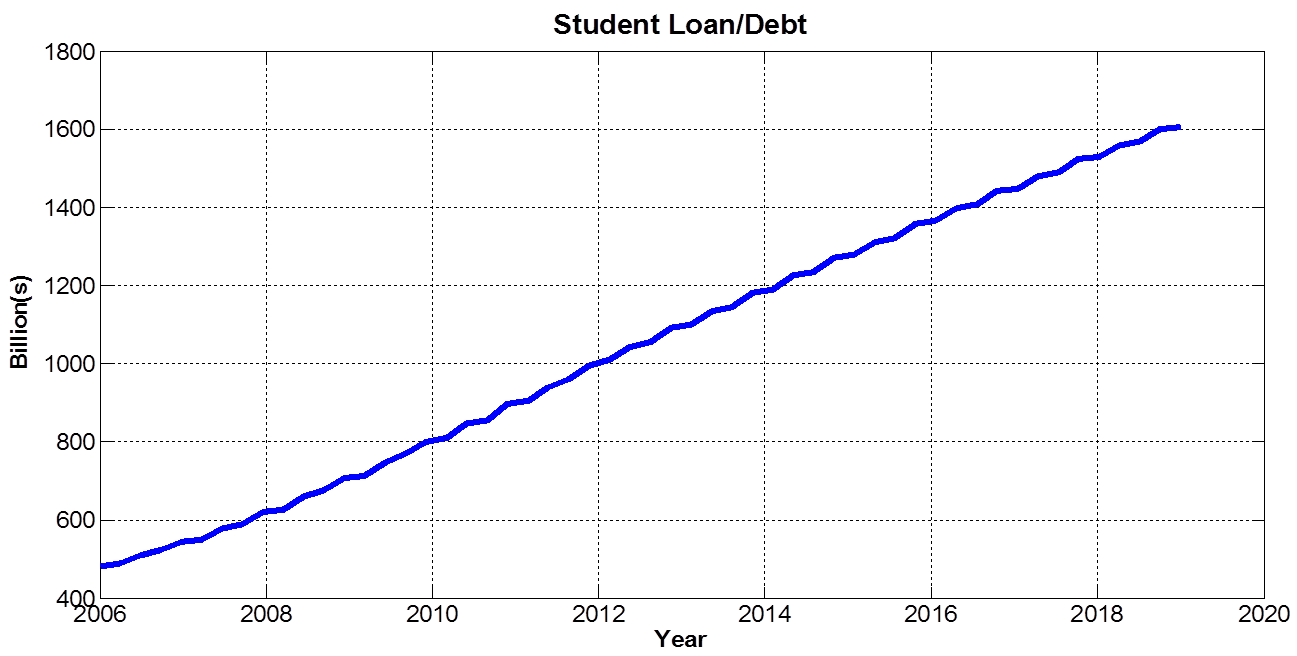

So what is the repercussion of all these? As soon as banks start making out loan to people, these new money gradually makes its way into the circulation which is why over the past decade, we have inflation through the roof. While the Fed will use Consumer Price Index (CPI) or Personal Consumption Expenditures (PEC) price index to show us that inflation isn’t all that bad, but we all know that these indexes either completely omit or being very conservative towards the cost of housing, food, and energy. It shouldn’t be all that complicated. Please just take a look around you. We have home prices doubling or even tripling, stock market hitting all-time record year after year, healthcare cost through the roof, corporate debt at all-time high every year, consumer debt at all-time high every year, student loan at all time high every year, the list goes on. If you haven’t noticed any of these, you must have not been living on earth this entire time. What more do we have to go through to realize that these monetary policy aren’t addressing the problems? These monetary policies ARE the problems.

This really isn’t hard math as scarcity is the most fundamental principle in economics. When the resources are limited, more money supply means inflation. Okay let’s be fair. If these new money are evenly distributed to everyone including ordinary citizens like you and I (imagine Fed deposits several million dollars to your personal bank account), it should be much less of a problem. But heck no, these money gets put in the hands of bankers so that they can immediately lend out and make the first hand profit off everyone else. Maybe this helps explain why even with trillions of dollars of economic stimulus, people are piling up more and more debt and become poorer by the day while the rich becomes even richer. Because this isn’t a fair game from Day 1. Can we still be so naive to think that Fed looks after the general public and not their banker friends?

Also it is just funny how we just came off one of the biggest financial collapse in our country in 07-08 due to people’s reckless spending behaviors, and our central bank was already there encouraging people to spend more money. This is like your friend was addicted to a drug resulting in some serious health problems and you went to help him by giving him more drug. Yes, that drug may relieve the problems temporarily but it also makes him more dependent to it. The more he uses the more tolerance he builds up and therefore requiring bigger and bigger dose to achieve same level of relief. How far do you think that will go before the body completely falls apart beyond repair? Similarly how far do you think our economy can last when our Fed had been purposely injecting these “stimulus zero-interest and Quantitative Easing drugs” into it for such as an extended period of time?

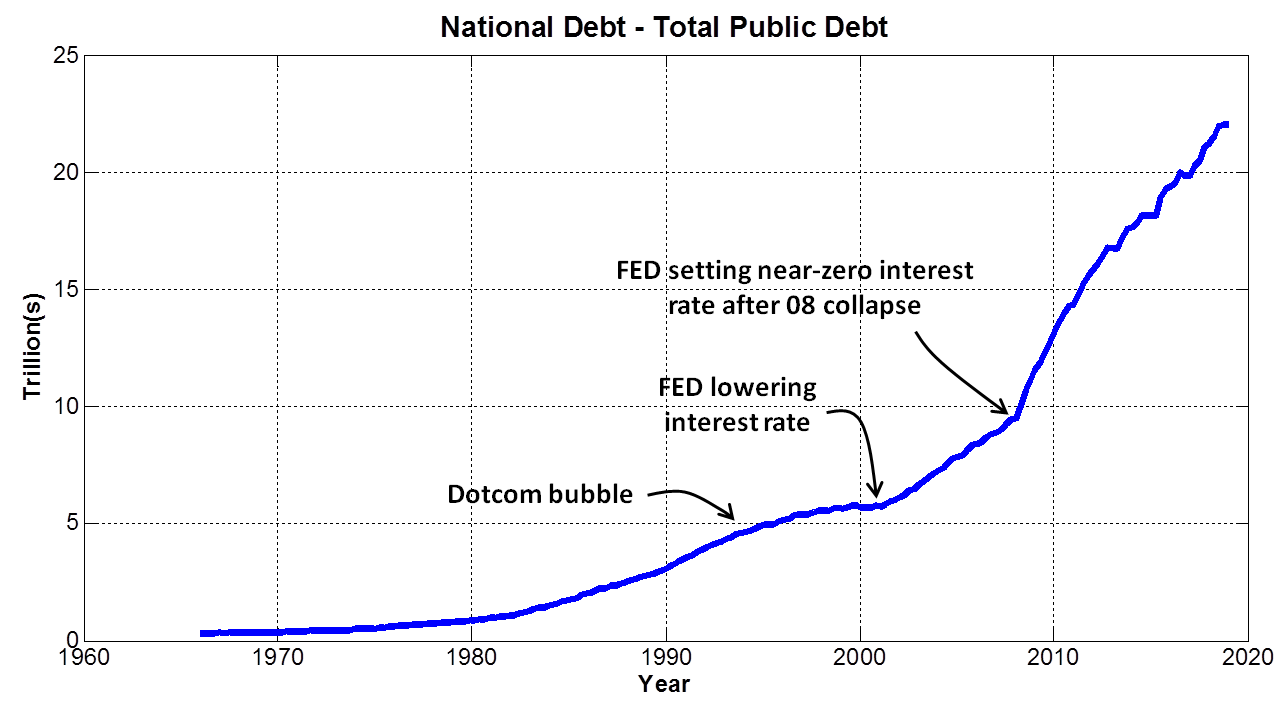

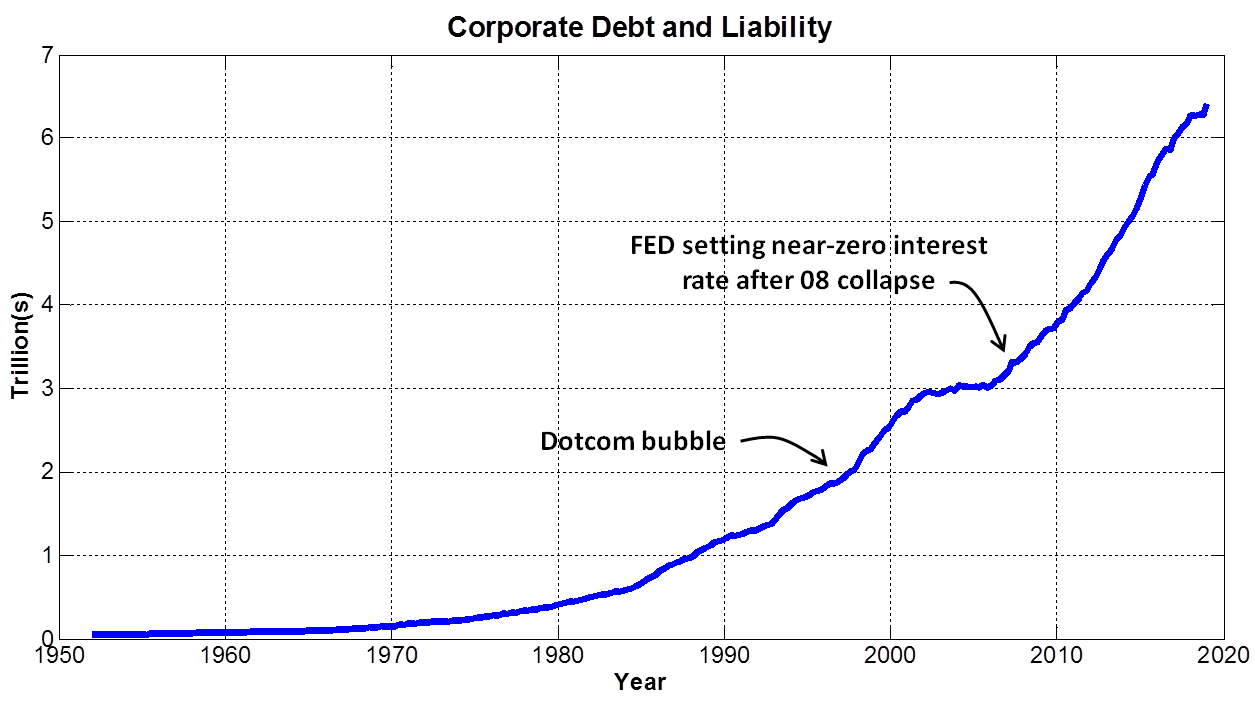

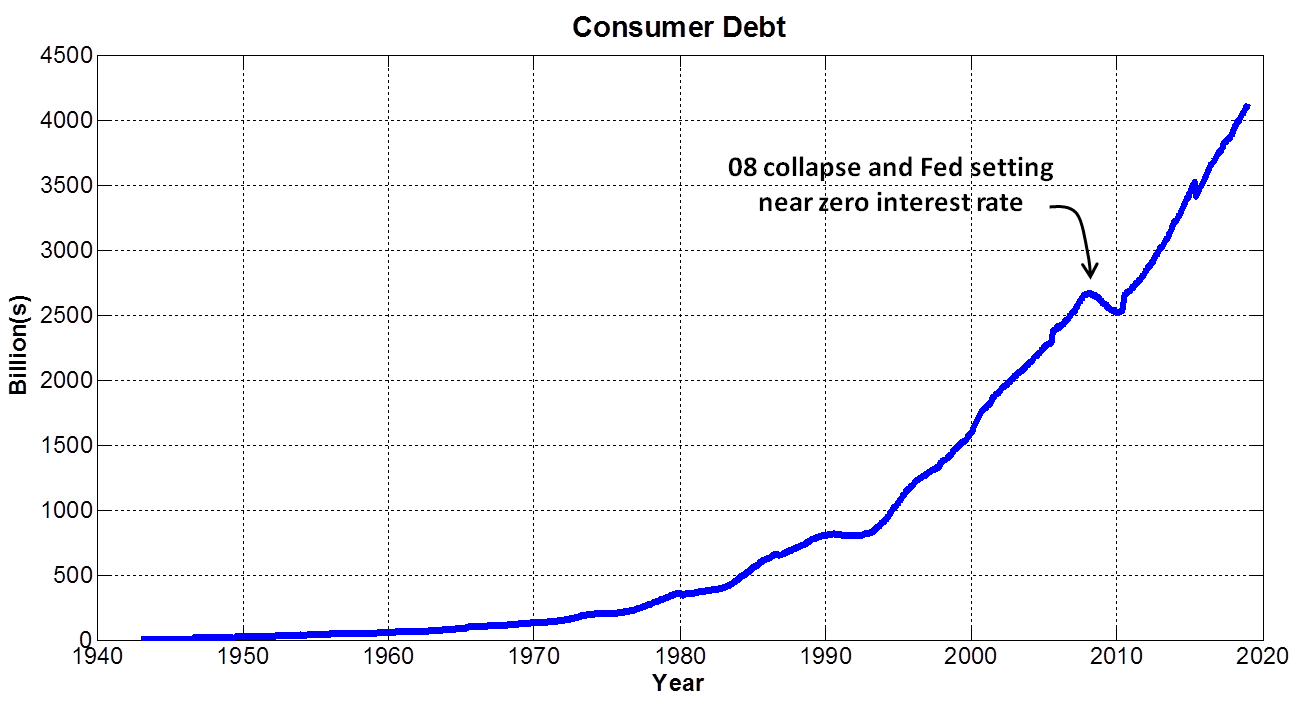

One of the direct consequences of Fed’s zero interest monetary policy and QE is the piling up of debt. Ladies and gentlemen, not only is our government racking up debt, individuals and businesses are also in some serious debt crisis. Here is a look at the respective debt levels for the federal government, businesses, individuals, and student loans.

It is not hard to see from these figures that the debt levels exploded as a result of Fed’s extended near-zero interest rate policy and Quantitative “money injecting” Easing. Not only does these monetary policies cause massive stock, real estate, and asset bubble across the board, individuals and businesses also need to take on more and more debt just to stay afloat. If the economy is doing so well as they claimed , aren’t people supposed to be paying off debt and becoming less burdened down by the debt?

It is interesting to see how the low-interest monetary policy has been nurturing this debt bubble for the past two decades. Now that this debt bubble has grown so large to the point where we could no longer afford to go back to higher interest rate. Just imagine that interest rates for your mortgage, car loan, business loan, credit card increase by just a few percent, right away we are probably going to be seeing big recession with foreclosures, repossession, business bankruptcy, and personal bankruptcy as most people are barely hanging on. These will then lead to collapsing of asset and real estate price. So does that mean we should be thanking Fed for keeping the interest rate low? Absolutely not. First as I mentioned, Fed can’t afford to raise the interest rate anymore. Second, they created this problem fundamentally. They used the low interest rate to punish savers and encourage people to borrow and spend the money for the last twenty years. They created this perception that money can be borrowed into existence. If you don’t have the money, that is okay, you can just borrow it, spend it, and worry about it later. Well there comes to a point where we really need to worry about it and that’s this giant debt crisis we find ourselves in.

The central bank has been given such an enormous amount of power in its ability to adjust the interest rate. In my opinion this power is nothing short of a financial weapon of mass destruction. Rather than exercising this power with caution and letting the free market run its own course, they chose to pull the pendulum towards one extreme for a very long period of time. And what do we get as a result of this? A gigantic debt bubble getting bigger everyday waiting to pop anytime. And make no mistake about it, when this bubble bursts, it will be singularly the worst nightmare the world has ever seen. It will be like a financial nuclear bomb that is going to affect every individual, business, and country. No one can really be immune from it.

No one really knows for certain how close we are to an economic collapse because only God knows what the future holds but at the same time God gave us a mind to seek him and to understand what really goes on in the world. There are many signs in our economy that shows a collapse is inevitable. Bible also prophesized that before the Second Coming of Jesus Christ, there will be a global economic restructure/reset. So this really isn’t a question of whether it will happen but a question of whether we will be ready when it happens. We really should be grateful that it hasn’t happened yet because our Lord has been restraining it to give us more time to prepare. This is why it says in 2 Peters 3:9

“The Lord is not slow in keeping his promise, as some understand slowness. Instead he is patient with you, not wanting anyone to perish, but everyone to come to repentance” 2 Peter 3:9

In my opinion, the next economic collapse will be centered around the issue of our debts, so it will most likely be a debt crisis. Unlike the 08 collapse where it primarily affected the subprime mortgage sectors, this next collapse may touch up debts that are much more personal to us including our consumer debt, business debt, and even national debt.

We don’t know what the triggering event of this may be but a debt crisis usually takes place when massive amount of people defaulting on their debts. Given that our debt levels have been on record high and counting, this could be a deflationary scenario where one sector of the economy gives out first and then starts the chain reaction of bankruptcy and foreclosure into other sectors since everything is so interconnected. Depending on the extent and severity of it, the end results are usually stock market tumbling, businesses closing, people losing jobs, home prices falling hard as a result of foreclosures. Bankruptcy may also hit home to the banking sectors resulting in bank failure, people losing their savings, and bank runs. When you have hungry people who lost everything, there will likely be riots and violence on the streets also.

While the deflationary correction of a debt crisis may be painful, it is actually the lesser of two evils consequence of our debt problems. Another much worse consequence of the debt crisis is for it to turn into a currency crisis which is actually another form of debt defaulting. This is equivalent to saying that we will never stop paying back what we owe except all the money we pay back is essentially worth nothing. Because our debts are hitting record level, a strong currency adds burden to our debts even more. This is why central banks from around the world have been keeping interest rate to record low for so long while injecting money into the system through rounds of QEs. If they continue to inject money into the system to suppress any signs of painful yet healthy deflationary correction, then we really are setting ourselves up for a hyperinflation currency crisis, which is the absolute worst thing that can happen to an economy because it wipes out everything. Please take Venezuela as an example to see what hyperinflation can do to a country. Bible did show indication that there will be a global economic reset prior to the Second Coming of Jesus Christ. To my worst fear, this could suggest hyperinflation taking place in a much larger scale although I am not sure that’s what will happen in the next collapse.

Now I am not here to instill fear nor am I here claiming that I know exactly what the future holds, I am just sharing with you why I think we are heading towards an economic collapse. If you wonder what you can do to be prepared, here are a few things: